Organizations that have a large number of fixed assets on their balance sheets are sometimes faced with the need to transfer some of their assets to conservation. At the same time, accounting workers have questions related to documenting such an operation.

In accounting, an object transferred for conservation continues to be included in fixed assets, and its value is not excluded from the property tax base.

For the purposes of corporate income tax, costs for conservation, re-preservation, and maintenance of mothballed assets are taken into account in non-operating expenses.

Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating corporate income tax.

The decision on conservation is formalized by order of the head of the organization.

This order must indicate the conservation period and list the measures that need to be taken to transfer the OS to conservation.

Afterwards, an act on transferring the OS to conservation should be drawn up.

There is no unified form of the act on the transfer of fixed assets for conservation, so it is drawn up in any form. The act is signed by the members of the commission and approved by the head of the organization. The act reflects the economic feasibility of mothballing a fixed asset object.

The act must indicate:

- OS transferred to conservation;

- date of transfer of the OS for conservation;

- activities that were carried out to transfer the OS to conservation;

- the costs of carrying out these activities.

For fixed assets mothballed for three months or less, depreciation during the mothballing period is accrued in the usual manner.

Depreciation refers to expenses for ordinary activities, regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period in which it is accrued (clause 5, paragraph 5, clause 8, clause 16 of the Accounting Regulations "Expenses organization" PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, clause 24 PBU 6/01).

For OS preserved for a period of more than three months (clause 23 of PBU 6/01, clause 63 of the Methodological Instructions dated October 13, 2003 N 91n):

From the first day of the month following the month of transfer to conservation, the accrual of depreciation stops;

It is worth noting that in accounting, the time period during which the property is mothballed (even if it exceeds a three-month period) will not affect its useful life.

But according to accounting laws, depreciation can be calculated even after the end of the useful life of fixed assets (clause 22 of PBU 6/01).

It follows from this that after the reactivation of objects, depreciation can be continued in the same manner until their cost is fully repaid.

Thus, from the first day of the month following the month in which the asset was re-mothballed, depreciation is resumed in the same amount as before mothballing.

Let's consider an example of OS preservation for a period of more than three months.

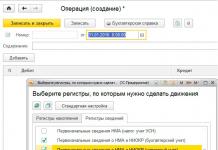

To pause the OS, you must use the document “Changing the OS State”. We will indicate the conservation date at the end of the month. In the header of the document, you must indicate the OS event, check the necessary flags “Reflect in accounting and tax accounting”, “Affects the calculation of depreciation (wear and tear)” (Fig. 1).

Let's consider the result of the document (Fig. 2).

To resume the calculation of depreciation on fixed assets, we will also use the document “Changing the state of the fixed assets.

When filling out the document, in the header you need to indicate “Date” and “FA Event”, set the flag “Reflect in accounting and tax accounting”, “Affects the calculation of depreciation (wear and tear)” and “Calculate depreciation” (Fig. 3).

Let's consider the result of reactivation of a fixed asset (Fig. 4).

Let's consider conservationfixed assets for a period of more than 3 months in program 1c accounting. With this period, depreciation ceases to accrue (see clause 23 of PBU 6/01 “Accounting for fixed assets”, clause 63 of the Methodological guidelines for accounting of fixed assets, approved accordingly by orders of the Ministry of Finance of Russia dated 30.03.01 No. 26n and dated 13.10.03 No. 91n).

The guidelines define restrictions on objects that can be subject to conservation. OS objects located in a certain technological complex and (or) having a completed cycle of the technological process are transferred to conservation. The minimum period for conservation of fixed assets is established by the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). The duration of conservation, according to clause 48 of the Regulations, cannot be less than 3 months.

To mothball fixed assets in the 1C Accounting program, you must enter the document “Change in the state of the OS”. This document is intended to suspend or resume depreciation on fixed assets.

— Select “Event” — “Mothballing” from the directory of events with fixed assets with the event type “Depreciation.”

— put a tick in the field “Affects the calculation of depreciation (wear and tear)”.

— there is no need to check the “Accrue depreciation” field.

After execution, the document will generate movements in the information registers “Accrual of depreciation of fixed assets” for accounting and tax accounting.

Important! Depreciation accrual stops from the next month.

Depreservation of the OS.

To remove a fixed asset from conservation and continue to calculate depreciation, we introduce a new document “Change in the state of the asset”.

— Select “Event” — “Removal from mothballing” from the event directory with the event type “Depreciation.”

— Let’s check the boxes “Affects the calculation of depreciation (wear and tear)” and “Calculate depreciation.”

Important! Depreciation begins to accrue from the next month.

Video tutorial on conservation of fixed assets:

Is conservation beneficial or not?

The head of the enterprise must create a commission to transfer fixed assets to conservation.

The commission must assess the economic benefit of mothballing fixed assets, draw up an estimate for their maintenance (which includes the amount of costs associated with the maintenance of the mothballed object), assess the technical condition for their subsequent re-mothballing, whether it is planned to use the fixed assets in the future, whether the costs for conservation of fixed assets, losses from the maintenance of an object that has not been transferred to conservation, whether the necessary qualitative characteristics of the fixed asset object will be preserved during the period of conservation.

It is also necessary to create an inventory commission to conduct an inventory of fixed assets subject to conservation.

Then the manager issues an order to transfer fixed assets to conservation.

The procedure for terminating and resuming the accrual of depreciation for mothballed fixed assets must be fixed in the accounting policies of the organization.

As a document, enterprises can use the Regulations on the procedure for preserving fixed production assets of enterprises, approved by Resolution of the Cabinet of Ministers of October 28, 1997 No. 1183 (hereinafter referred to as Regulation No. 1183).

Clause 1 of Regulation No. 1183 states that conservation is mandatory for implementation only by strategic enterprises, as well as those established on state property.

Private enterprises can use this document as general recommendations.

Conservation may not be economically profitable, then the organization has the right not to preserve fixed assets that are not used in current production activities, but may include the costs of their maintenance as expenses.

There may be negative consequences for VAT. Therefore, when making a decision, estimate the amount of VAT deductions.

During conservation, fixed assets are subject to property and transport taxes.

Conservation is not only a temporary cessation of use of a fixed asset, but also maintaining it in good condition so that the object can be used again.

During conservation, the inventory card of an OS object is placed in a separate file cabinet.

Conservation is beneficial for organizations that do not plan to end the current year with a profit.

Fixed assets are the property that is used as a means of labor in the production of goods, provision of services, or performance of work for more than a year.

Please note that from the beginning of 2016, the minimum cost of the OS began to be one hundred thousand rubles. In accounting, this amount is forty thousand rubles.

In this article we will look at all options for the receipt of fixed assets and equipment in 1C 8.3 Accounting.

The purchase of fixed assets can be registered in the 1C Accounting 3.0 program with the document “Receipts (acts, invoices)”, selecting the appropriate type (“equipment” or “fixed assets”).

For convenience, this document is also located in the “Fixed assets and intangible assets” menu in the form of two items with already established types: “Receipt of fixed assets” and “Receipt of equipment”.

A document with the type “Fixed Assets” is needed to account for those assets that do not require installation and additional costs.

- In the latest editions of 1C Accounting 8.3 (starting from 3.0.45), when using this type of operation, you do not need to additionally create a “” document. All postings are made as receipts with the type of operation “Fixed Assets”, which greatly simplifies the life of accountants.

- The type of operation “Equipment” implies a purchase on accounts: 08.04.1 and 07. Equipment received on account 07 requires further installation. The equipment that arrived to the account on 08.04 does not require installation, and in the future should be accepted for accounting. VAT is reflected on the account on 19.01.

In our example, we will consider the receipt of fixed assets, since this functionality is new. To do this, in the “Fixed assets and intangible assets” menu, select the “Receipt of fixed assets” item. In the list form that opens, create a new document.

As you can see, it combines the details of receipt and acceptance for accounting.

Fill out the counterparty and the agreement in the header of the document. The method for reflecting expenses will be filled in automatically, but you can adjust it if desired. You can also indicate the location of the OS and the financially responsible person, but these fields are not mandatory. In the event that this object will be rented out, it is necessary to set the appropriate flag.

It is very convenient to create a new fixed asset directly from the tabular part of this document. For the created object, the OS accounting group will be set in accordance with the value specified in the header. The depreciation group is filled in when recording a document with a value corresponding to the specified service life.

Postings for capitalization of OS in 1C

Post the document. All his movements will be displayed in the postings. In our case there will be three wirings:

- Dt 04/08/02 - receipt of fixed assets

- Dt 01.01 – acceptance of fixed assets for accounting

- Dt 19.01 – VAT

VAT upon receipt of fixed assets

In this example, VAT was posted, since the document parameters indicate that it is not included in the price. To change this setting, follow the corresponding hyperlink in the document header and check the “Include VAT in price” flag. Then, when posting the document, there will be no movement on the account 19.01.

In the purchase book, VAT will be reflected only after this document has been received.

If the receipt was reflected in a document with the transaction type “Receipt of equipment”, then it is additionally necessary to accept the fixed asset for accounting. This document is located in the menu “Fixed assets and intangible assets”, item “Acceptance for accounting of fixed assets”. We will not consider filling out this document, since we filled out all the necessary data, both for receipt and for acceptance for accounting, using the “Receipt of fixed assets” transaction type.

Invoice registration

Let's register an invoice for this document. To do this, enter its number, date at the bottom and click on the “Register” button.

Also watch a video on how to formalize the commissioning of an OS in two steps - first receipt, and then acceptance for accounting:

Fixed assets are transferred to conservation in order to ensure the safety and serviceability of objects during downtime. The organization decides independently whether or not to transfer idle fixed assets to conservation, since this is its right and not its obligation. The decision on conservation is formalized by order of the head of the organization (clause 63 of the Methodological guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

In accounting, an object transferred for conservation continues to be listed as part of fixed assets, and its value is not excluded from the property tax base (clause 1 of Article 374, clauses 1, 2 of Article 375 of the Tax Code of the Russian Federation).

For the purposes of corporate income tax, costs for conservation, re-preservation, and maintenance of mothballed assets (including repairs and security) are taken into account in non-operating expenses (clause 9, clause 1, article 265 of the Tax Code of the Russian Federation).

For fixed assets mothballed for three months or less, depreciation during the mothballing period is accrued in the usual manner.

For fixed assets mothballed for a period of more than three months, depreciation is calculated (clause 23 of PBU 6/01, clause 2 of Article 322 of the Tax Code of the Russian Federation):

- terminates on the first day of the month following the month of transfer to conservation;

- is renewed in the same amount as before conservation from the first day of the month following the month in which the fixed asset was re-preserved.

To suspend or resume the accrual of depreciation on fixed assets in “1C: Accounting 8” edition 3.0, the document is intended Changing the OS state(chapter OS and intangible assets - OS depreciation parameters).

When filling out the document, you must indicate the following details in the header:

- OS event- change in the state of a fixed asset, which is reflected by this document in the organization’s accounting;

- flag Affects the calculation of depreciation (wear and tear)- a sign that the document will affect the calculation of depreciation. To suspend or resume depreciation calculation, you need to set this flag;

- flag Calculate depreciation (wear and tear)- a sign of depreciation. If the flag is set, depreciation will be resumed for fixed assets. If the flag is cleared, depreciation will be suspended. This change will apply starting next month.

- flags Reflect in buh. accounting, Reflect in tax. accounting are established depending on in which of the accounts it is necessary to suspend or resume depreciation. One of these flags must be set.

Stop accruing depreciation from the 1st day of the month following the month in which the fixed asset was transferred for conservation (clause 6 of Article 259.1, clause 8 of Article 259.2 of the Tax Code of the Russian Federation). With the non-linear method, in this case it is necessary to reduce the total balance of the depreciation group by the amount of the residual value of the fixed asset transferred for conservation (clause 8 of Article 259.2 of the Tax Code of the Russian Federation). Resume the calculation of depreciation from the next month after the reactivation of the fixed asset (clause 7 of article 259.1, clause 9 of article 259.2 of the Tax Code of the Russian Federation). In this case, after re-preservation, depreciation on the fixed asset is calculated in the order that was in effect before the start of conservation. The useful life of a fixed asset is extended by the number of months during which depreciation was not accrued due to the asset being mothballed. Such rules are established in paragraph 5 of paragraph 3 of Article 256 of the Tax Code of the Russian Federation.

Conservation of fixed assets. accounting and taxation

For accounting purposes, the organization’s accounting policy states that when objects are mothballed for a period of more than three months, the accrual of depreciation: – is suspended from the month following the month the mothballing began; – is resumed from the month following the month of removal from mothballing. The estimated conservation period exceeds three months.

Therefore, based on the order of the manager, Alpha’s accountant stopped accruing depreciation on mothballed facilities from July 1. Depreciation was resumed on December 1 after the facilities were re-opened.

Advice: in your accounting policy for accounting purposes, establish the same procedure for stopping and resuming depreciation on fixed assets mothballed for a period of more than three months, as in tax accounting.

How to formalize and reflect conservation of fixed assets in accounting

Attention

Situation: is it possible to take into account utility costs, security costs and lighting of a mothballed building when calculating income tax? Answer: yes, you can. Expenses for mothballing and re-mothballing production facilities and facilities, as well as the costs of their maintenance during the mothballing period, are taken into account as non-operating expenses (subclause

9 clause 1 art. 265

Tax Code of the Russian Federation). Thus, the organization has the right to reflect in tax accounting the costs of utilities, security and lighting of a mothballed building in order to preserve the mothballed fixed asset. At the same time, the costs of maintaining mothballed production facilities must be documented and economically justified (clause.

1 tbsp. 252 of the Tax Code of the Russian Federation). The Ministry of Finance of Russia adheres to a similar opinion in letters dated March 18, 2009 No. 03-03-06/1/164, dated July 20, 2007 No. 03-03-06/1/507.

Conservation of fixed assets

Conservation helps preserve the characteristics of fixed asset objects necessary for their operation in the future, since during conservation the use of fixed asset objects is stopped, additional measures are taken to maintain them in good condition, access of unauthorized persons to the fixed asset object is limited, or the fixed asset object is placed in a specially designated area. storage place. Documentation of the transfer of an object to conservation Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating income tax.

In both accounting and tax accounting, the procedure for transferring fixed assets to conservation is the same. It is established according to clause 23 of PBU 6/01 “Accounting for fixed assets” and clause 3 of Article 256 of the Tax Code of the Russian Federation.

The object is transferred to conservation by decision of the manager for a period of more than three months.

Conservation of fixed assets. accounting, postings

Before issuing an order to transfer fixed assets to conservation, the head of the enterprise, on the basis of an application received from the initiator of the transfer of fixed assets to conservation, must create a commission for the transfer of fixed assets to conservation from representatives of the administration, technical services, the head of the relevant department to which they belong OS objects subject to conservation, accounting and economic services for the examination of OS objects subject to conservation, preparation of documents for conservation, assessment of the economic feasibility of conservation of OS, drawing up cost estimates for the maintenance of mothballed OS objects, assessment of the technical condition of these objects during their subsequent reactivation, as well as inventory commission to conduct an inventory of fixed assets subject to conservation.

Transfer to conservation: accounting and tax accounting

Important

If the preservation period is shorter, depreciation is calculated in accordance with the generally established procedure. As in accounting, for tax accounting purposes, fixed assets transferred for conservation for more than 3 months are excluded from depreciable property (clause

3 tbsp. 256

Info

Tax Code of the Russian Federation). Typically, OS objects that are located in a certain technological complex or have a completed cycle of the technological process are transferred for conservation. It should also be noted that for profit tax purposes, the period during which an item of fixed assets is mothballed increases its useful life (clause.

3 tbsp. 256 of the Tax Code of the Russian Federation). After the re-conservation of such property, depreciation on it is calculated in the same order as before the transfer to conservation. According to paragraph 2 of Art.

"1s:accounting 8" (rev. 3.0). how to reflect the transfer of wasps for conservation (+ video)?

This act, approved by the head of the organization, will be the primary document in order to: take into account conservation costs in expenses; suspend the accrual of depreciation on fixed assets transferred to conservation for more than three months. The reactivation of the OS is also formalized by an act approved by the head of the organization.

VAT. If the fixed assets are used in activities subject to VAT: input VAT on goods (works, services) purchased for conservation of the fixed assets is taken for deduction in clause 1 of Art. 172 Tax Code of the Russian Federation; previously accepted for deduction of input VAT on fixed assets transferred to conservation is not restored. Letter of the Federal Tax Service dated June 20, 2006 N ШТ-6-03/ Property Tax. During the conservation period, the cost of fixed assets is not excluded from the property tax base (regardless of how the tax is calculated - based on the cadastral or book value) p.

1 tbsp. 374, paragraph 1, 2 art. 375 Tax Code of the Russian Federation.

Accounting for the conservation of fixed assets is carried out in accordance with Rules 6/01 and Methodological Instructions. There is no provision for extending the useful life period by more than three months.

But in accounting, depreciation can be calculated even after this time. In this regard, after the return of fixed assets to the asset, calculations are carried out in the same way as before their withdrawal.

Termination and resumption of accruals Many specialists have a question from when to suspend and then begin calculating depreciation for fixed assets transferred to conservation for a period of more than 3 months. The company sets the month for termination and resumption of accruals independently.

The option that is chosen must be recorded in its accounting policy. The legislation does not establish a specific moment for stopping and resuming payments for funds mothballed for more than 3 months.

How to transfer the main product to conservation

If such costs appear when depreservation and conservation of fixed assets are carried out, the postings will be as follows: Db 91-2 Kt 10 (23, 68, 60, 69...) - costs for depreservation, conservation and storage of fixed assets are included. BASIC: taxation of profits Tax accounting of expenses will depend on the purpose of the property that is being preserved.

If operating systems are used in the non-production sector, then costs are not taken into account. This is due to the fact that these expenses will not be justified in an economic sense; they do not relate to the company’s income-generating activities.

If fixed assets under conservation are used in production, then the costs will reduce the profit tax base. The costs of putting fixed assets into temporary non-use are included in non-operating expenses. Accrual methods When calculating, the tax base is reduced in the period to which non-operating expenses relate.

Property tax, transport tax Fixed assets during the period of conservation do not cease to be subject to: – property tax (Article 375 of the Tax Code of the Russian Federation). The exception is movable property registered as fixed assets from January 1, 2013. Such property is not recognized as subject to property tax (subclause 8, clause 4, article 374 of the Tax Code of the Russian Federation); – transport tax (Article 358 of the Tax Code of the Russian Federation). Simplified tax system The tax base of simplified organizations that pay a single tax on income is not reduced by the costs of preserving fixed assets.

With this object of taxation, no expenses are taken into account (clause 1 of Article 346.18 of the Tax Code of the Russian Federation). For simplified organizations that pay a single tax on the difference between income and expenses, conservation costs reduce the tax base, provided that they are listed in Article 346.16 of the Tax Code of the Russian Federation.

Transfer of fixed assets to conservation

Conservation of fixed assets is carried out when they are temporarily not in use. This procedure is present in the practice of many companies.

Order on conservation of fixed assets This document is mandatory. The management decision must include the following information:

- Reasons for temporary non-use of the OS.

- Preservation period of fixed assets.

- Positions of responsible employees.

The manager appoints specialists who are responsible for both the immediate conservation and subsequent re-preservation of fixed assets.

In addition, persons are identified to ensure their proper storage during temporary downtime. Additional registration Employees must conduct an inventory and draw up an appropriate act of conservation of fixed assets.

This document confirms the fact of the transaction.

Transfer of fixed assets for conservation in 1s 8.2

The organization itself must develop its form and approve it in its accounting policies. This document must be signed by: the head of the enterprise; members of the commission; heads of departments that control the conserved property. Reflection of conservation in accounting If the head of the organization decided to mothball the equipment, the fixed asset transferred to conservation continues to be accounted for in accounting in account 01 “Fixed Assets”. The transfer of an object to another quality is shown only in analytical accounting. Thus, fixed assets that are under conservation must be accounted for separately, therefore, a separate sub-account “Fixed Assets for Conservation” should be opened to account 01 “Fixed Assets”. In the case of transfer of fixed assets to conservation for a period of more than 3 months, depreciation on them is not accrued in accounting (clause 23 of PBU 6/01).